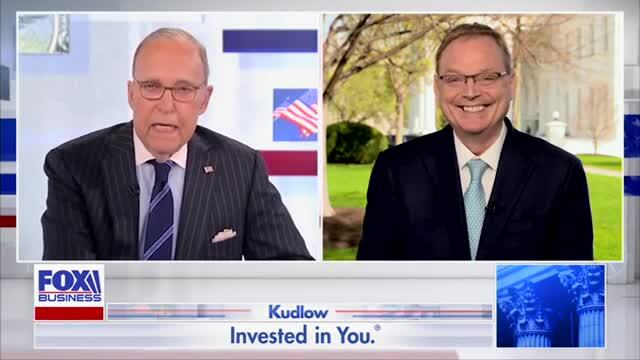

Hassett: The New Trump Tax Proposals Are Incredibly Popular with GOP Members

EXCERPT:

HASSETT: "Absolutely. I want to thank you for bringing me on and all your thought leadership on how to think about supply-side tax cuts and one of the things we did yesterday is had this so called the big 6 meeting where the speaker of the house, the majority leader, Senators Crapo, we all got together and talked we about how to get the Senate and house and Jason Smith and get together on a bill and I don’t think I have ever seen people from the House in the Senate work more collegially and better together where the senators are negotiating with their guys who are difficult to negotiate with and saying maybe we got to do it this way and the House people saying we have to do it that way so I left with high confidence of the the tax bill is going to pass this year and there’s going to be big spending cuts which are great for bond markets and big supply-side tax changes and I think the headline from yesterday’s meeting and today where we met with members of the House ways and means committee which will start the tax bill process hopefully really soon is the new proposals by the president are incredibly popular with members and when you think of the economics of it, then they are really really going to be great for the economy. I will talk about the idea of reducing the tax we charge people if they’ve got social security and they want to add to their income a little bit and get a job. That will create a big increase in labor supply. It is a supply-side tax reduction for people who need that money. It is not for the rich and we’ve got a reduction in taxes, elimination of taxes on overtime which is a really important thing for hourly workers, people who respond to supply-side changes a lot so if you cut the tax on hourly workers they are the ones who can move their hours around, salaried people tend to not change their labor supply in response to policy so on and so on and so on so right now there’s an incredible enthusiasm about the tax bill and I don’t think it is anything like what I signed 2017 where we were able to bring it along the finish line, this is a really almost euphoric Congress that understands the we’ve got an unusual opportunity to have a historic contribution to the American palate."