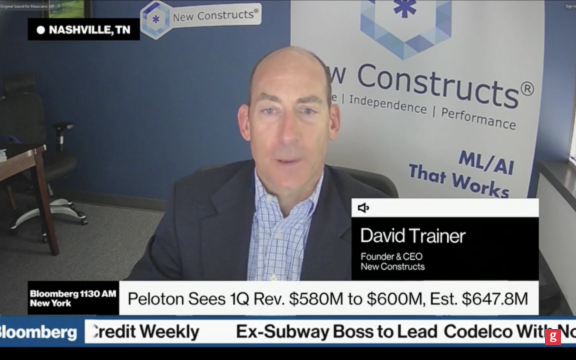

PERSON: David Trainer

Employer

New Constructs

Position

CEO

Biography

David Trainer is a Wall Street veteran and corporate finance expert. He specializes in reversing accounting distortions on the underlying economics of business performance and stock valuation. He was a member of FASB’s Investor Advisory Committee from 2013-2017 and is author of Modern Tools for Valuation (Wiley Finance 2010).

David combined his expertise and an analytical focus to found New Constructs, which assesses the core impact on stocks from accounting rule changes and corporate actions to create the best fundamental research in the business – as proven by Ernst & Young’s white paper “Getting ROIC Right” and Harvard Business School’s case study “New Constructs: Disrupting Fundamental Analysis with Robo-Analysts”.

Mr. Trainer makes frequent appearances in TV and print to share his insights on market trends, macro-economic news, and individual stock insights, as well as cutting–edge research on ETFs and mutual funds. You can find his most recent stock picks here.

His stock-picking success has been well-documented since 2005, including features on CNBC, in Institutional Investor Magazine, in Barron’s.

David founded New Constructs to use the latest Natural Language Processing technology to identify and analyze every data point in an SEC filing from the MD&A, financial statements, and footnotes. New Constructs covers over 3000 stocks, 7,000 mutual funds, and 400 ETFs by leveraging its Robo-Analyst technology.

New Constructs footnote analysis drives truly unconflicted and comprehensive fundamental research into quality-of-earnings and valuation. New Constructs’ stock rating and ETF & mutual fund rating methodologies are 100% transparent, as are all calculations made within their models.

Prior to founding New Constructs in 2002, Mr. Trainer spent over 6 years as a stock analyst on Wall Street. In 1996, he joined Credit Suisse First Boston where he created an economic (as opposed to accounting)-based earnings model and brand for CSFB equity research. He spearheaded the effort to apply consistent economic earnings analysis (a.k.a. ‘EVA’) across all industries globally. In 1997, Mr. Trainer developed and managed the Value Dynamics Framework project, a separate business for CSFB across three continents.

In 1999, Mr. Trainer transitioned these skills into equity research coverage of the financial services sector for CSFB where he applied value-based analysis to consumer finance, asset management and broker-dealer firms and developed a proprietary framework that linked customer satisfaction to the valuation of credit card companies.

In November of 2000, Mr. Trainer joined Epoch Partners (acquired by Goldman Sachs in July 2001) where he covered the Customer Relationship Management Software industry. There, he developed a proprietary framework that quantified the ROI of Customer Relationship Management Software products. Prior to Wall Street, Mr. Trainer was an executive compensation consultant with Arthur Andersen. In 1994, Mr. Trainer earned his B.S. in International Business from Trinity University in San Antonio, TX.

>> New Constrcuts

David combined his expertise and an analytical focus to found New Constructs, which assesses the core impact on stocks from accounting rule changes and corporate actions to create the best fundamental research in the business – as proven by Ernst & Young’s white paper “Getting ROIC Right” and Harvard Business School’s case study “New Constructs: Disrupting Fundamental Analysis with Robo-Analysts”.

Mr. Trainer makes frequent appearances in TV and print to share his insights on market trends, macro-economic news, and individual stock insights, as well as cutting–edge research on ETFs and mutual funds. You can find his most recent stock picks here.

His stock-picking success has been well-documented since 2005, including features on CNBC, in Institutional Investor Magazine, in Barron’s.

David founded New Constructs to use the latest Natural Language Processing technology to identify and analyze every data point in an SEC filing from the MD&A, financial statements, and footnotes. New Constructs covers over 3000 stocks, 7,000 mutual funds, and 400 ETFs by leveraging its Robo-Analyst technology.

New Constructs footnote analysis drives truly unconflicted and comprehensive fundamental research into quality-of-earnings and valuation. New Constructs’ stock rating and ETF & mutual fund rating methodologies are 100% transparent, as are all calculations made within their models.

Prior to founding New Constructs in 2002, Mr. Trainer spent over 6 years as a stock analyst on Wall Street. In 1996, he joined Credit Suisse First Boston where he created an economic (as opposed to accounting)-based earnings model and brand for CSFB equity research. He spearheaded the effort to apply consistent economic earnings analysis (a.k.a. ‘EVA’) across all industries globally. In 1997, Mr. Trainer developed and managed the Value Dynamics Framework project, a separate business for CSFB across three continents.

In 1999, Mr. Trainer transitioned these skills into equity research coverage of the financial services sector for CSFB where he applied value-based analysis to consumer finance, asset management and broker-dealer firms and developed a proprietary framework that linked customer satisfaction to the valuation of credit card companies.

In November of 2000, Mr. Trainer joined Epoch Partners (acquired by Goldman Sachs in July 2001) where he covered the Customer Relationship Management Software industry. There, he developed a proprietary framework that quantified the ROI of Customer Relationship Management Software products. Prior to Wall Street, Mr. Trainer was an executive compensation consultant with Arthur Andersen. In 1994, Mr. Trainer earned his B.S. in International Business from Trinity University in San Antonio, TX.

>> New Constrcuts

ClipsBank

Full

Compact

NewsBase

Full

Compact

RadioBank

Full

Compact

PodBank

Full

Compact

TranscriptBank

Full

Compact

No data found